| CATEGORY: | Private Sector |

| CSA PROJECT: | Climate Smart Agriculture |

| SCALE: | National coordination actions |

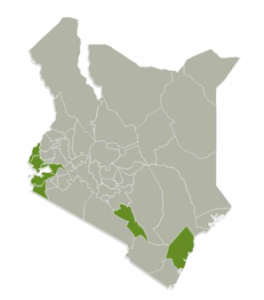

| LOCATION: | Kisumu, HomaBay, Siaya, Migori, Busia, Kilifi, Makueni and Nakuru. |

| PERIOD OF THE PROJECT: | 2011- present |

| GRANT SIZE OF THE PROJECT: | N/A |

Rafiki Microfinance

Summary of Actions

Rafiki Microfinance is a micro lender, which provides loans to suppliers and producers to market agricultural produce on behalf of farmers. The organization seeks to promote poultry, dairy and crop farming and provide farmers with farm inputs on credit to boost agriculture. Some of the key activities of the organisation has been to promote farming of climate resilient crops in Western and Eastern Kenya and value-chain development, specifically for cassava, sorghum and dairy value chains.

Context

Most farmers across the country face the effects of climate change and variability. . Generally, farmers report poor distribution and higher variability and unpredictability of rains, affecting the growing seasons, as well as increased cases of floods and drought. Due to the changing climatic conditions, there is need to plant drought tolerant crops to cope with the climatic changes

Objective

To promote the growing of resilient crop for cassava and sorghum.

Key Interventions

| BEYOND FARM LEVEL | TARGET BENEFICIARIES | INDICATORS MONITORED |

| Provision of credit facilities financing. | Smallholder farmers. | – agricultural lending portfolio (agriculture loan book) net income disposal to the smallholder farmers farm produce output |

Participation In Key Climate & Agriculture Networks

The organisation is a member of the Climate Smart Agriculture Multistakeholder Platform.

Involvement in CSA

Relevance of CSA MSP to Work

- Coordination and networking

- Financing of climate smart agricultural actions

- Networking

- Develop new business

Recommendation On Ways To Support MSP

- Developing specific climate smart agriculture policies, legislations, strategies, plans

- Developing capacities of key actors involved in climate smart agriculture implementation

- Providing financial support to proposed initiatives.

Lessons and Challenges in Implementation of CSA Project

Some of the challenges encountered in the implementation of the CSA project are lack of collatirisation among the majority of smallholder farmers to secure credit facilities, low liquidity cashflow among the smallholder farmers and lack of sufficient data within the sector for precise decision-making.

Relevant Links & References

https://www.businessdailyafrica.com/magazines/Microfinancier-promotes-agribusiness-inVihiga/1248928-2549140-kbci7n/index.htmlhttp://www.rafikibank.co.ke/

Organisation Information and Contact Address incase of Follow Up

Name: Alex Kiragu

Email address: akiragu@rafiki.co.ke

Phone address: 254 722 242 465

Organisational Website: http://www.rafikibank.co.ke/