| CATEGORY: | Private Sector |

| CSA PROJECT: | Picture Based Insurance Soil Moisture Index Insurance Getting Farmers Insurance Ready Pest and Disease Index |

| SCALE: | National |

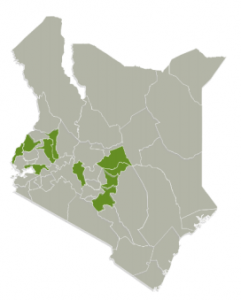

| LOCATION: | Nyandarua, Machakos, Meru, Embu, Tharaka Nithi, Uasin Gishu, Elgeyo Marakwet, Busia, Bungoma and Kisumu |

| GRANT SIZE OF THE PROJECT: | N/A |

AGRICULTURE & CLIMATE RISK ENTERPRISE (ACRE AFRICA)

Summary of Actions

- Capacity building by training over 450 Village Champions in Kenya on Agri-Insurance as a risk mitigation approach to address both weather relater and non-weather related risks through ACRE’s index insurance services; Weather Index (WII), Area Yield Index (AYII) Multi-peril crop Index (MPCI) and the hybrid index that combines both index and multi-peril.

- Collection of farmer profiles and onboarding of them onto various bundled products & services digitally

- Partnerships with other stakeholders for bundled and integrated solutions to ensure increase of agricultural insurance awareness and uptake.

- Engaging key partnerships that help re-define our product development to suitable, affordable and accessible products for smallholder farmer e.g. the commoditized micro-insurance product (BIMA PIMA) that is packeged as a voucher card and activated through USSD dial.

- Development and incorporation of digital tools to simplify farmer onboarding process and performance tracking.

- Development of business training content/curriculum on risk management and agriculture insurance.

- Develop disaggregated data collection framework and tools that enable reporting on gender inclusion trends.

- Farmers training on risk management via various channels e.g. Village champions, field days, group meetings, collaborative planning.

- Use of digital tools and smartphone applications for data collection and dissemination of advisories on agri-risk management to profiled farmers.

Context

The livelihoods of millions of smallholder farmers across the developing world are under threat from extreme weather events, such as droughts, floods and heatwaves, with risks projected to significantly increase in future due to climate change. Crop insurance protects farmers against financial risks posed by weather unpredictability and has been widely advocated as a tool to help farm households escape poverty traps and invest in climate-smart high-productivity agriculture.

Agriculture index insurance, has in the recent past been accepted as a risk transfer innovation that enables small holder producers protect their production from climate risk and build their resilience. Though proven as a sustainable approach to unlock investments in agriculture for smallholder farmers, improving their resilience and productivity, very few farmers have taken up agriculture index insurance.

In Kenya only 13 percent of insurers are active in the sector. Less than 1% of industry premiums earned in 2015 were from micro-insurance. So clearly access to and use of micro-insurance remains a concern. There are main key drawbacks to the industry. First is distribution. The current distribution infrastructure doesn’t appear cost-suited to drive insurance penetration, partly because underwriters still treat the industry’s products like conventional insurance products. Another major challenge is affordability of insurance by low income earners, who constitute the largest segment of our society. Micro insurance, therefore, presents itself as the most appropriate mechanism the insurance industry could use in making insurance affordable to low income earners.

ACRE Africa has identified that in order to sustainably increase uptake of agriculture insurance products, the high touch approach of the village champions’ model (whose primary goal is to distribute agriculture insurance solutions to small holder farmers) needs to be supported and strengthened. This is necessary in order to keep the champions engaged thereby reducing attrition rates and to strengthen partnerships

and synergize project activities where possible through a focused product uptake approach that will be implemented through ongoing interventions.

The insurance products to be distributed via the champions network include: Picture based insurance (to address the challenge of basis risk), soil moisture index (to support the weather index product), commoditized agriculture insurance products (for ease of distribution) one of the key products here is BIMA PIMA.

Some of the partnerships we have signed off include local insurance companies such, the state department of agriculture and county governments, research institutions including CABI, KALRO, IFPRI and Wageningen and other private sector organizations including financial service providers and input companies.

Project Objective

Picture Based Insurance

In partnership with IFPRI, Wageningen University and KALRO, initiated a climate smart crop insurance weather index solution product that incorporates use of farmer-issued smartphone photos, satellite imagery, weather station data, agronomic records and online data archives to provide a robust insurance and advisory. Researchers will use satellite and cellphone imagery to verify losses, observe management

practices and engage with farmers. The project promotes the adoption of productivity-enhancing yet resilient technologies through bundling with stress-tolerant seeds and remote advisories. The ground pictures taken by farmers will help reduce monitoring costs, minimize basis risks and create synergies with climate-smart technologies. The project part of the Cultivate Africa’s Future (CultiAf) program that is jointly funded by International Development Research Centre (IDRC) and the Australian Centre for

International Agricultural Research (ACIAR).

Soil Moisture Index (Index Insurance)

This is a daily soil moisture product service at field level (100 m), which provides direct information about the water availability for crops at a more granular scale compared to the usual Africa Rainfall Climatology (ARC2) of (10*10km). The project aims at reducing basis risk, creating premium affordability and training on risk management and good agricultural practices. With this type of insurance, the indemnity is based on realizations of the soil moisture measured over a pre-specified period of time using satellites. The

insurance is structured to protect against index (soil moisture content) deviations that are expected to cause crop losses.

Getting Farmers Insurance Ready – Bridging the protection gap

In a bid to address the problem of low literacy levels and low insurance uptake, ACRE Africa initiated an insurance preparedness farmer program through the Alliance for Green Revolution Agriculture (AGRA).

The program leverages on the local communities’ trusted social structures to promote uptake of insurance services through development of village-based champions to lead sustainable risk management awareness campaigns and distribute insurance products designed for small holder producers in the rural

communities. The objectives include:

- To increase the user case of smallholder farmers thereby enhancing their resilience by

developing and utilizing a focused product uptake campaign. - To establish a consistent contact point with smallholder farmers through the network of trained village champions.

- To increase awareness of agriculture insurance solutions by strengthening partnerships and synergizing on project activities to train 100,000 small holder farmers.

Pest and Disease Index

Farmers need more than weather insurance to mitigate against farming risks – pests and diseases are also a common risk. ACRE Africa has partnered with Center for Agriculture and Bioscience International (CABI) who are using data to help farmers manage pests via platform called PRISE (Pest Risk Information SErvice)

that forecast pests risks using a combination of earth observation technology, satellite positioning and plant-pest lifecycle.

The project aims at bringing together an integrated suite of services whose value proposition is not only tied to access to technical information, models and alerts, but also provision of a comprehensive social support that will enable women farmers to engage with the high-worth value chain in their nearby urban markets, detailed information on good agricultural practice and financial support. Including direct access to micro-credit and novel pest insurance products, appropriate climate-smart approaches, risk management advice and entrepreneurship training, that will in turn support ACRE Africa’s network of village champion farmers who then transfer this knowledge and information to their peers

Key Interventions

Participation In Key Climate & Agriculture Networks

ACRE Africa is a member of: MSP-CSA, County value chain specific platforms, Asal Stakeholders Forum, Regional Livestock Working Group, Kenya Platform on Climate Governance, Kenya Private Sector Alliance (KEPSA), Private sector dialogue platforms, African Fine Coffees Association (AFCA).

Involvement in CSA

Relevance of CSA MSP to Work

- Research

- Policy formulation

- Knowledge dissemination

- Technology transfer

- Coordination and networking

- Information about CSA

- Networking

- Learning and exchange

- Reporting and showcasing

- Develop new business

- Influence policy environment

Recommendation On Ways To Support MSP

- Developing specific climate smart agriculture policies, legislations, strategies, plans,

- Dissemination of climate smart agriculture knowledge and technologies

- Capacity building of key actors involved in climate smart agriculture implementation

- Monitoring, evaluation and audit of climate smart agriculture aspects to enhance accountability

- Support coordination of action.

WHAT APPROACHES ARE YOU USING TO IMPLEMENT CSA

- Sustainable Agriculture

- Good agricultural practices

- Disaster risk reduction

- Agri-insurance as a climate risk mitigation

- Digitcal inclusion

PICK ANY OF THE ACTIVITIES YOU ARE IMPLEMENTING AND WRITE COUNTIES OF

IMPLEMENTATION AND CSA INDICATORS MONITORED

LESSONS LEARNED AND CHALLENGES IN IMPLEMENTATION OF CSA PROJECT

Lessons learned and challenges

- Agri-insurance still has a low penetration in Africa of less than 2% of total agriculture farming population. This remains a challenge occasioned by lack off or little information on insurance.

- The expensive nature of agri-insurance compared to other classes of insurance.

Few insurance companies are actively underwriting agriculture insurance due to its high loss ratio. - Lack of production data, making product development that would aid reduction in premium rates difficult.

- COVID-19 pandemic has been a key challenge to implementation of projects in 2020. This has led to halting of project activities caused by lack of mobility, low product distribution since this is done through our village champions who distribute to farmer groups or door-door campaigns.

- Due to COVID-19 challenges, there has been need for remote training and adaptation strategies during the 2020 short rains season. This also called for project synergies to source for funds to provide personal protective equipment to facilitate field activities while adhering to COVID-19 restrictions

Success

- Developed smartphone applications which is available on Google Play store e.g. “Seeitgrow”. The applications have been adapted to cover crops such as Maize, Sorghum and Green grams and livestock.

- Provision of crop specific advisories on good agricultural practices, weather, pests and diseases using the developed mobile platform applications.

- Scaling of our Weather Index Insurance product into a dynamic, accessible and tangible insurance product that allows smallholder farmers to purchase insurance products in small affordable bits. This is through using scratch cards as a distribution medium and mobile money (Mpesa) as a premium collection channel.

- Establish a self-sustaining network of over 450 Village-based champions in Kenya to facilitate knowledge transfer of intergrated risk management like Good Agronomical Practises, agriinsurance and CSA at scale.

- Since inception, ACRE Africa has reached over 2M farmers across Africa.